How Mortgage Broker can Save You Time, Stress, and Money.

Wiki Article

The 3-Minute Rule for Broker Mortgage Calculator

Table of ContentsOur Mortgage Brokerage StatementsMortgage Broker Vs Loan Officer - The FactsThe Buzz on Mortgage Broker MeaningWhat Does Mortgage Broker Assistant Mean?Things about Broker Mortgage RatesSee This Report on Mortgage BrokerageMortgage Broker Job Description Can Be Fun For EveryoneThe Best Guide To Broker Mortgage Meaning

A broker can contrast loans from a financial institution as well as a credit report union. According to , her initial responsibility is to the establishment, to make certain financings are correctly protected and also the debtor is entirely qualified and also will make the car loan payments.Broker Payment A mortgage broker stands for the customer greater than the lending institution. His responsibility is to obtain the borrower the ideal offer feasible, no matter of the organization. He is usually paid by the funding, a kind of payment, the difference in between the rate he receives from the loan provider as well as the price he gives to the customer.

5 Easy Facts About Broker Mortgage Fees Explained

Jobs Defined Knowing the benefits and drawbacks of each may help you make a decision which occupation path you intend to take. According to, the main distinction in between the two is that the financial institution home mortgage police officer represents the products that the financial institution they function for deals, while a home mortgage broker functions with several loan providers as well as acts as a middleman in between the loan providers as well as customer.On the various other hand, bank brokers may find the task ordinary after a while given that the procedure generally continues to be the very same.

An Unbiased View of Mortgage Broker Salary

What Is a Funding Officer? You may know that discovering a finance police officer is a vital step in the procedure of getting your loan. Allow's review what loan policemans do, what knowledge they require to do their task well, and whether lending policemans are the ideal choice for consumers in the financing application testing process.

Broker Mortgage Rates - Truths

What a Lending Officer Does, A financing police officer works for a financial institution or independent loan provider to aid debtors in requesting a funding. Because lots of customers work with financing police officers for home mortgages, they are usually referred to as home mortgage finance policemans, though lots of funding officers help consumers with other fundings.A car loan police officer will meet with you as well as examine your creditworthiness. If a lending policeman thinks you're qualified, after that they'll recommend you for authorization, and also you'll have the this page ability to advance in the process of acquiring your lending. 2. What Car Loan Officers Know, Financing officers have to be able to deal with consumers and also little company proprietors, and they need to have considerable understanding concerning the sector.

The smart Trick of Mortgage Broker Average Salary That Nobody is Talking About

4. Exactly How Much a Lending Police Officer Prices, Some funding police officers are paid using payments. Mortgage financings often tend to cause the biggest compensations due to the fact that of the dimension and workload related to the financing, but payments are frequently a negotiable pre paid cost. With all a loan policeman can do for you, they often tend to be well worth the price.Loan police officers recognize all about the many types of finances a lending institution may supply, as well as they can give you recommendations about the ideal option for you as well as your situation. Discuss your requirements with your financing policeman.

The Ultimate Guide To Broker Mortgage Calculator

The Function of a Funding Police Officer in the Screening Process, Your finance officer is your direct call when you're applying for a lending. You will not have to stress about frequently calling all the individuals entailed in the home mortgage car loan process, such as the expert, genuine estate agent, settlement attorney as well as others, due to the fact that your funding officer will certainly be the factor of call for all of the included celebrations.Because the process of a financing purchase can be a facility as well as expensive one, numerous customers prefer to function with a human being as opposed to a computer. This is click why financial institutions may have several branches they wish to serve the potential customers in various areas that desire to meet in person with a financing officer.

The Buzz on Broker Mortgage Calculator

The Function of a Finance Officer in the Funding Application Process, The home loan application process can feel overwhelming, especially for the new property buyer. When you work with the right lending officer, the procedure is really pretty basic.During the lending handling phase, your loan policeman will contact you with any kind of concerns the car loan cpus may have about your application. Your funding policeman will after that pass the broker mortgage application on to the underwriter, who will assess your creditworthiness. If the expert authorizes your car loan, your finance police officer will certainly after that accumulate as well as prepare the proper lending shutting documents.

The smart Trick of Mortgage Broker Meaning That Nobody is Discussing

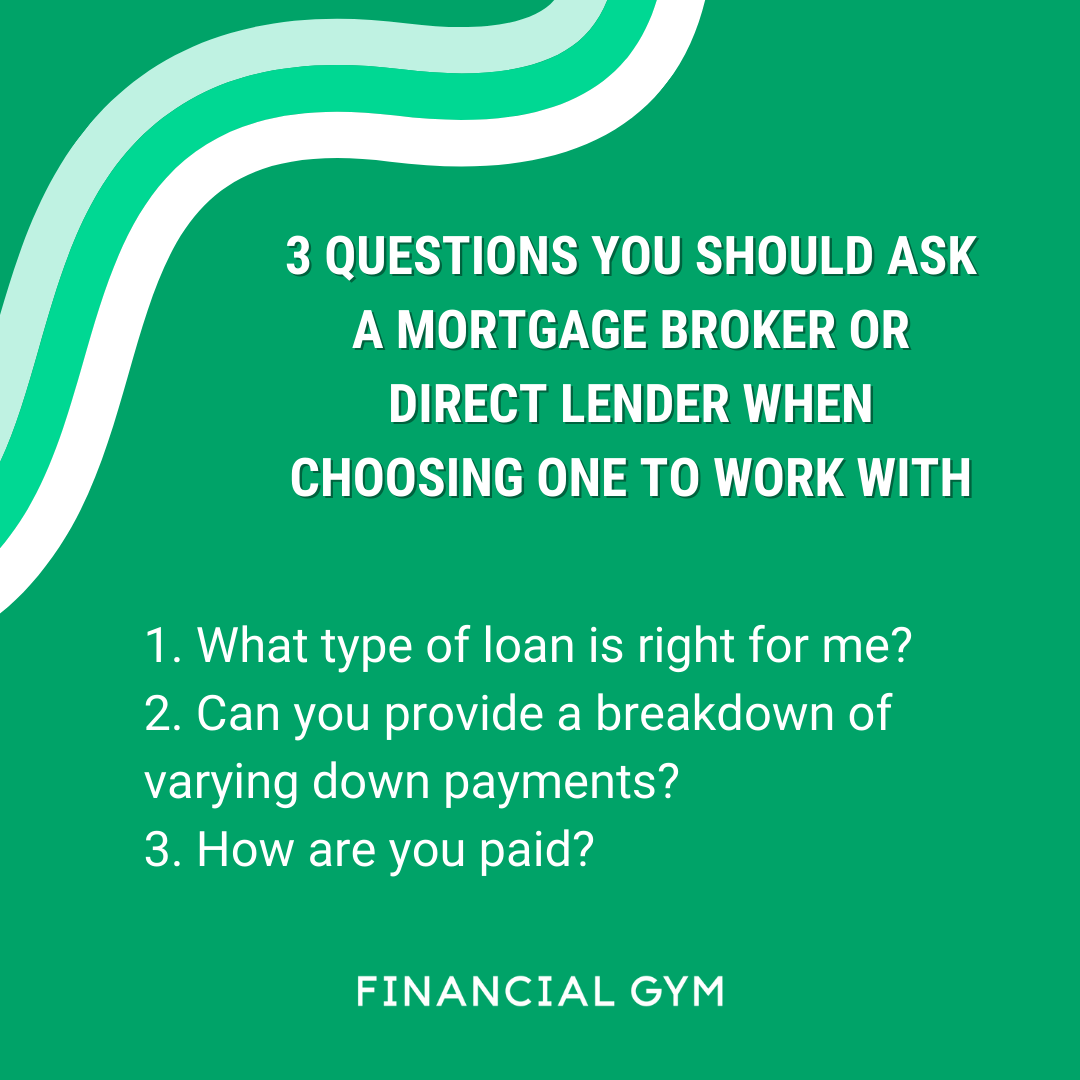

Exactly how do you choose the best lending officer for you? To begin your search, begin with lending institutions that have a superb reputation for exceeding their clients' assumptions as well as maintaining sector criteria. As soon as you have actually chosen a lending institution, you can after that begin to tighten down your search by talking to finance officers you may intend to collaborate with (mortgage broker association).

Report this wiki page